Intel has been behind in the high-end networking switch market despite its acquisition of Barefoot Networks in 2019. Our estimates place Intel’s Tofino switches as a lower market share player versus Broadcom, Nvidia, Marvell, and Cisco. Intel’s Networking and Edge (NEX) chief, Nick McKeown, has even admitted Intel is behind Broadcom in technology.

Q: Are you still on track with Broadcom’s “Tomahawk” switch ASICs? You are working on Tofino 3, and they are working on Tomahawk 5.

A: We are a bit behind. With the acquisition of Barefoot by Intel, this has taken a hiccup. We’re very committed to catching up.

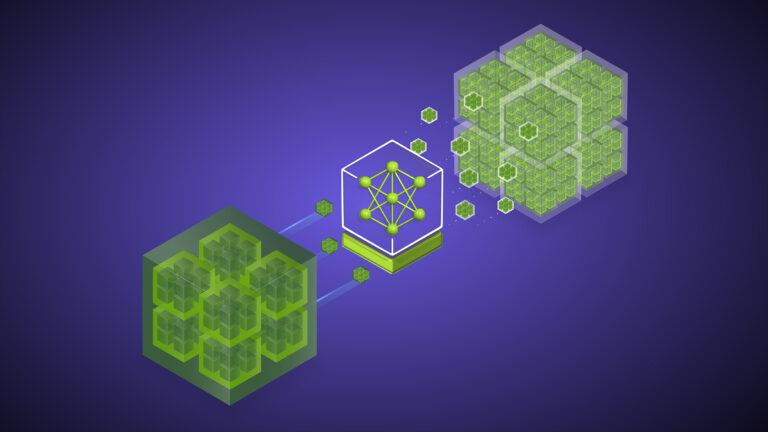

Intel’s 25.6T Tofino 3 is in the market, but Intel is still working on the 51.2T Tofino 4 switch. Despite this setback, it may shock many that Intel has been designed into 3 of the 5 next-generation 51.2T ethernet switches. Intel is obviously in their own Tofino 4 switch, but they are also in 2 of the other major vendors’ 51.2T switches, Broadcom Tomahawk 5, Cisco Silicon One, Nvidia Spectrum-4, and Marvell Teralynx 9. Read this report to find out which switches they were designed into.

Cisco

Cisco is one of the most prominent players in the switch world via their switching and routing box sales, but they are also starting to break into the merchant switch business. For example, Cisco sells their in-house Silicon One ASIC to Meta for top-of-rack switching. Cisco currently uses a combination of TSMC and Samsung, but Intel has won the next generation of switches.

While there is no official confirmation, it appears that Cisco will be shipping Intel fabbed and packaged switch ASIC for the 51.2T generation of switches. This foundry business was partially won by Intel’s process and packaging technology, but also because of Intel’s other expertise. Intel likely assisted Cisco with some of the heavy lifting on design work. As we said in the past, Intel’s silicon photonics technology is world-leading and a Trojan Horse in the foundry business.

Nvidia

Nvidia was the first to unveil a 51.2T switch with the Spectrum-4 lineup. This switch utilizes a chiplet design with at least 1 chiplet using TSMC N5. Nvidia says the switch ASIC is 100 billion transistors. This chip is fabbed and packaged by TSMC (InFO-R), so no direct Intel silicon content.

According to Nvidia, this switch will not sell as merchant silicon, only as full switch boxes. The Spectrum-4 switch is a standard switch with pluggable optics or direct attached copper at the back of the switch. These boxes are currently sampling and will ship in volume next year.

Marvell

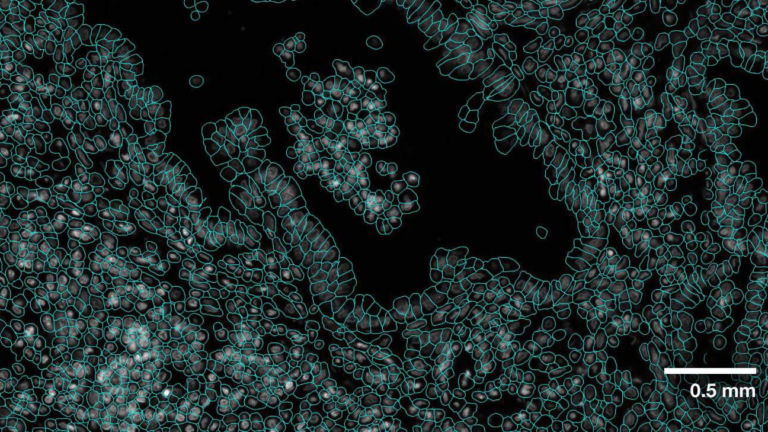

The Innovium Teralynx 9 Switch is Marvell’s 51.2T generation. While it hasn’t been officially announced, we know it uses near-package optics. TSMC fabs the switch ASICs. We believe GlobalFoundries manufactures these Marvell designed optical tiles.

Teralynx 7, the 12.8T switch generation, is shipping in volume, and Teralynx 8, the TSMC 7nm based 25.6T switch generation, is expected to ship in volume next year. Teralynx 9 51.2T is likely even later than Intel’s Tofino 4 51.2T.

Broadcom

Broadcom is the titan of the switching industry, leading in market share for switch ASICs. This dominance is particularly prevalent in the high-end switch market, where Broadcom captures the majority market share despite the existence of 4 well-funded competitors. Recently Broadcom announced the Tomahawk 5, 51.2T switch.

The switch is completely monolithic and has ~100B transistors. TSMC fabricates the switch die on the 5nm node. The most significant change with Tomahawk 5 is that it finally brings optics closer to the switch which is important for SerDes design as 100G PAM4 SerDes are difficult to manufacture and transmit data reliably.

With previous generation ethernet switches, most in-datacenter runs were still done with direct attached copper, which is much cheaper. With the 50G SerDes, silicon photonics transceivers started gaining a significant share for in-datacenter runs. This is because SerDes’s reach over direct attached copper began to shrink rapidly to roughly 10 meters.

Now with 51.2T switches running 100G SerDes, the reach is even more limited. In most cases, runs cap out at 4 meters. Top of rack switches would barely be able to connect to all the servers in their rack, let alone other racks of servers. Some datacenters have combatted this issue by moving the top of the rack switch to the middle of the rack to minimize the reach required. This improves the reliability of data sent over the shorter direct attached copper runs.

Moving to Co-Packaged Optics or Near Package Optics is crucial to being able to have network runs between multiple racks. In the 102.4T 200G PAM4 generation, all switches may have to move to near or in package optics. This move isn’t only for the distance of networking runs, but also for power. Broadcom claims their solution of near-package runs can achieve 50% of the power savings versus pluggable optics.

At OFC in March 2022, Broadcom and Ragile Networks partnered to show off the Tomahawk 5 Switch early. The switch they showed off was in the co-packaged optics version and was quite a shock as the optical modules are not from Broadcom.

These optical modules are Intel 3.2Tbps 8×400Gbps FR4 & DR4 3.2T. Intel has a design win with Broadcom’s next-generation Tomahawk 5 switch ASIC. Broadcom is currently sampling the switch ASIC and will be shipping it in volume by the end of 2023.

To be clear, this switch ASIC will be offered in the normal switch form factor without Intel’s optics. Sorry for the clickbait. The take-up rate of the normal switch form factor could be limited because direct attached copper runs cap out at 4 meters and front panel optics are inefficient compared to the co-packaged version.

Only Intel and GlobalFoundries have the capabilities to fabricate optics that are this advanced. Broadcom is attempting to design its own optical modules with GlobalFoundries as the foundry in the future. The timeline for this is unknown. If they are willing to work with Intel on this currently, they could be collaborating on more in the future. Furthermore, if Broadcom’s in-house effort fails, Intel is the only backup.

Another firm we have discussed heavily is Ayar Labs. They are focused on the compute market, not the ethernet switching market, so Ayar isn’t an option either. Intel is a big beneficiary by having silicon content in the majority of next-generation 51.2T switches. In the future, this share is likely to increase with the 102.4T generation.

There is a mid-cap company that benefits even more from the transition to near-package and co-packaged optics. They currently have majority share in the silicon photonics market with a very durable moat.

We will discuss this public mid-cap firm in the subscriber-only section as it is an interesting investment opportunity.