Nvidia has just announced its latest financial results and, who’d a thunk it, the company has beaten expectations—and fears of an AI bubble burst—with record revenues. Overall, Nvidia raked in $57 billion in the third quarter of 2025.

That’s 62% up on the same quarter in 2024 and 22% up on Q2 2025. It was enough to have CEO and leather jacket impresario Jensen Huang comment, “Blackwell sales are off the charts, and cloud GPUs are sold out.”

Reflecting the importance of Nvidia not just to the ongoing AI boom but the entire global economy, markets across the world rallied in response to Nvidia’s record earnings. Nvidia’s own share price went up, too, inevitably.

However, at the time of writing, Nvidia’s current share price of around $196 in after hours trading is still well down on its October peak of $212, perhaps reflecting that even these new and impressive results aren’t enough to entirely erase concerns over a mooted AI bubble and what might happen if it bursts.

As for the future, Nvidia is predicting even higher revenues. It has next quarter pencilled in at $65 billion and Nvidia CFO Colette Kress predicted another $350 billion in AI GPU sales between now and the end of 2026. That’s an average of $70 billion in AI GPU sales, alone, per quarter.

Apart from the headline results, there are a couple of additional takeaways of interest. First, Nvidia’s profit’s on that $57 billion were a hefty $32 billion. In other words, Nvidia has massive margins.

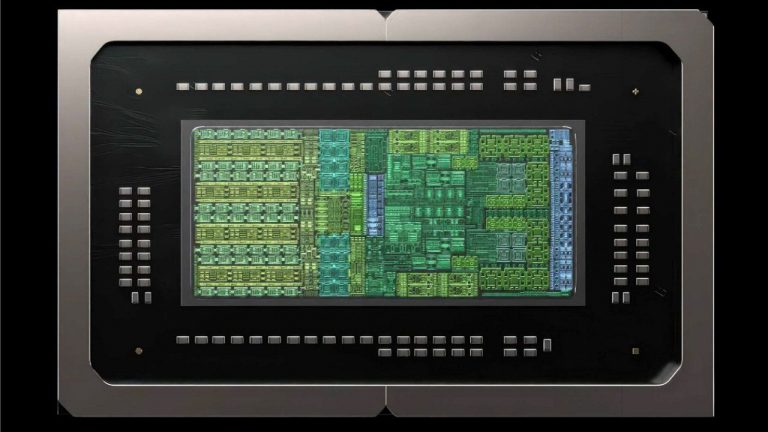

The greatest money maker the world has ever known? (Image credit: Nvidia)

Second, and more directly relevant for us, gaming revenue was $4.3 billion, down 1% from the previous quarter but up 30% from a year ago. So, the RTX 50 family of gaming GPUs is still selling very nicely.

With all that in mind, one immediate conclusion is that Nvidia has plenty of margin to soak up recent price rises in the memory and storage markets. Net income of $32 billion on $57 billion sales means that profits will hardly evaporate on the back of more expensive memory.

Sadly, however, we still think it’s more likely that GPU prices will rise in the near future, something that’s reportedly coming for AMD graphics cards and you have to think Nvidia will emulate.

In the end, this is all both completely mind boggling and business as usual for Nvidia of late. Oh, and if you’re wondering what happens to all this cash, a great deal of it is being pumped back to shareholders.

“During the first nine months of fiscal 2026, Nvidia returned $37.0 billion to shareholders in the form of shares repurchased and cash dividends. As of the end of the third quarter, the company had $62.2 billion remaining under its share repurchase authorization,” Nvidia also announced. So, there you go.